YouHodler Review

Are you considering depositing your crypto assets on YouHodler to earn interest on your coins? The crypto lending platform promises an annual interest rate of 8% on stablecoins or 3% on your bitcoin. Is the offer from YouHodler too good to be true, or is YouHolder a legitimate platform? Find out in our YouHodler review.

PROS

- Transparent business model

- Most reliable crypto interest account

- Easy swaps between FIAT and crypto

- Wide range of supported coins

CONS

- Trading features are risky

- Withdrawal fees

- Strict KYC

YouHodler in Numbers

When reviewing any crypto lending platform, it is essential to look at its track record to understand better the risk and opportunities of depositing crypto in exchange for interest.

While the platform's development started in 2017, the launch happened in November 2018.

Since then, YouHodler has attracted more than 211.000 active users. Crypto holders hold on average $5,866 on YouHodler.

8.48% of users on YouHodler hold BTC in their crypto wallets. On average, users earn 8.05% interest per year.

YouHodler Requirements

Registering on YouHodler is straightforward. You need your email address to access your account. To use it, you must verify your identity with your ID and pass the KYC requirements, including submitting your personal information and a selfie.

The KYC requirements for crypto transactions are minimal. However, to transact FIAT, you must provide more information about yourself.

- Be over 18 years old.

- NOT reside in the following countries: USA, Afghanistan, Bangladesh, China, Cuba, Germany, Iran, Iraq, North Korea, Pakistan, Sudan, Syria, Crimea

What’s worth mentioning is that the savings feature on YouHodler isn’t available for Swiss users.

When we chatted with the YouHodler support team, they informed us that currently, YouHodler doesn’t have a proper license to run the business in the USA.

While some platforms like Coinloan or Nexo don’t care much about the legal restrictions, it is good to hear that YouHodler aims to expand into different markets only with a dedicated license.

Ready to earn interest on your crypto?

Risk and Return

You will expose yourself to risks when depositing your money to your wallet at YouHodler. The risk will depend on the products that you will be using.

To better understand YouHodler’s services, please refer to our “Usability” section, where we explain how they work.

You will expose yourself to the counterparty risk regardless of which product you choose. As soon as you deposit your crypto on YouHodler, you will lose your utility of the coin in exchange for additional perks such as a loan or interest on your crypto deposits.

You can never eliminate the counterparty risk, but let’s review some points that will help you decrease it.

YouHodler stores your crypto on hot and cold wallets. Ledger Vault is offered cold wallets, which is the custodian of YouHodler. Ledger provides a crime insurance program that ensures your crypto assets for up to $150 M. The insurer is Arch UK Lloyds of London syndicate.

Storing your crypto assets on a cold wallet is industry-standard nowadays, as this reduces the risk that you might lose your crypto during a hacking attack on YouHodler.

In 2019, hackers exposed specific datasets from YouHodler's databank Source. According to our discussion with CEO Ilya Volkov, none of the sensitive data, such as credit card information, was exposed, as mentioned in the article.

While YouHodler is a member of the Blockchain Association, which acts as a self-regulatory entity within the crypto community, it doesn’t mean that your data is 100% protected at all times.

What are YouHodler’s rates?

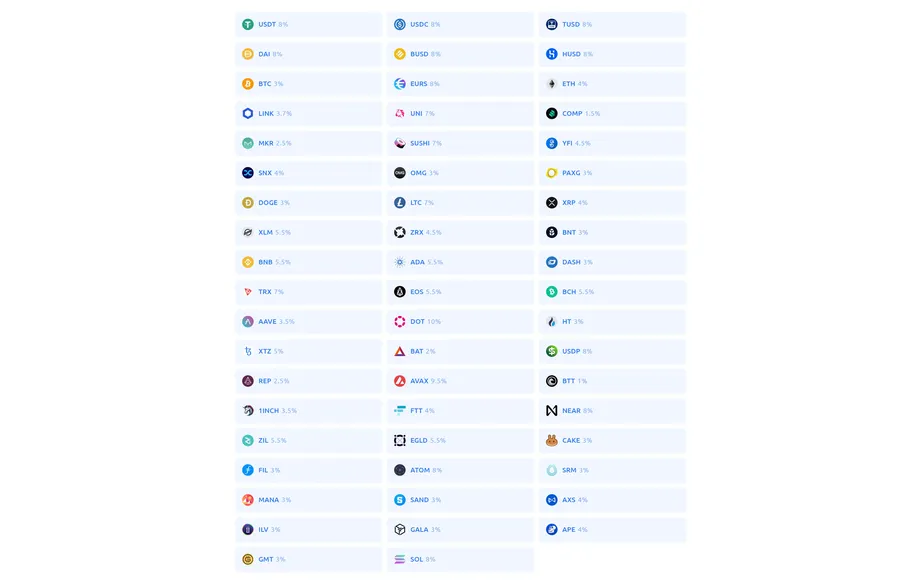

When depositing your valuable crypto assets, you want to ensure that you also get the highest interest rates, right? YouHodler offers some of the best rates in the industry. The platform supports 54 digital assets at the moment.

Here is a quick overview of the rates for the most popular cryptos:

| Coin | Interest Rate |

|---|---|

| BTC | 3% |

| ETH | 4% |

| XRP | 4% |

| LTC | 5.5% |

| DAI | 8% |

| USDT | 8% |

| USDC | 8% |

| EURS | 8% |

What’s likely the best feature of YouHodler is that you don’t need utility coins like the Crypto.com Earn or Nexo platforms to unlock higher rates. The reward scheme on YouHodler is relatively straightforward, and the list of supported assets is also comprehensive.

The offered rates change occasionally. Consult our dedicated table above to view the current rates.

YouHodler doesn’t share much about how they use your deposits publically; however, by contacting YouHodler, they have confirmed that they use it as “part of their liquidity pool to provide collateralized loans.” Continue reading to learn more about YouHodler's business model.

How does YouHodler make money?

We have investigated the business model of YouHodler and concluded that it's likely one of the most transparent models in the industry.

The platform uses your deposits ONLY to support their lending products within YouHodler. This business model is much more transparent as all loans are backed by collateral, eliminating the borrower.

Unlike on many other crypto-lending platforms, YouHodler doesn't risk your deposits in DeFi protocols or speculate with them, which is the case with Nexo (one of the most questionable companies we have ever seen).

No comments:

Post a Comment